|

DEPARTMENT

RESULTS |

|

|

|

Goal:

Increase the speed, accuracy, convenience and ease of tax filing and paying |

|

Why

is this goal important?

Because

the revenue system relies on voluntary compliance, it must have the support

and cooperation of its citizens. The department’s role is to make it easy

and convenient for taxpayers to fulfill their filing and paying obligations.

The department also has an obligation to manage its operations as

efficiently as possible, and to make prudent investments in appropriate

technology.

Electronic filing and paying helps us

accomplish both goals. For taxpayers, e-filing is fast, secure, and

accurate; for the department and the state, e-filed returns and payments are

less costly to process than paper returns.

|

|

How will this goal be accomplished?

Our

transition from paper began in 1994, with mandatory paperless filing for the

newly enacted MinnesotaCare tax. Since then, we have worked to shift other

business taxes to e-filing and paying. In 2001, e-filing reached another

milestone when the sales and withholding tax systems eliminated paper

filing; businesses now file these returns via the Internet, or by telephone.

Individual income tax filers are also

leaving paper behind. The department works to encourage e-filing through

partnerships and information campaigns directed at individuals and tax

preparers. In addition, we have worked with the IRS to increase the number

of e-filings.

|

|

What is

Revenue's progress to date?

●

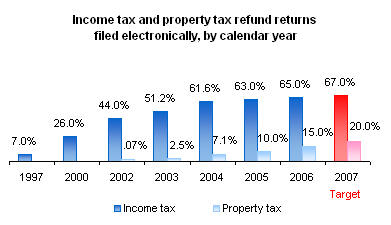

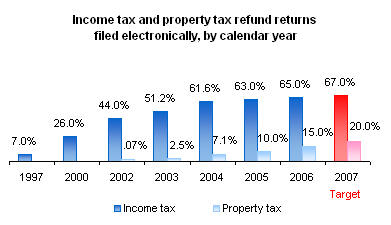

The number of returns filed electronically has steadily increased since

2001. This transition from paper to electronic filing is improving

the speed, accuracy and convenience of tax filing for citizens. The result

is that taxpayers who file electronically can receive their tax refunds in

just a few days and about 98 percent of all income tax filings are error

free.

In 2006, 65 percent of individual income tax returns and 15 percent of

property tax refund returns were filed electronically. The department

exceeded its 2006 electronic filing goals- 60 percent for individual income tax

and 10 percent for property tax refund filers.

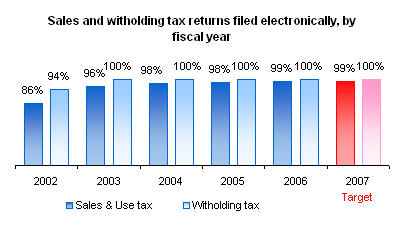

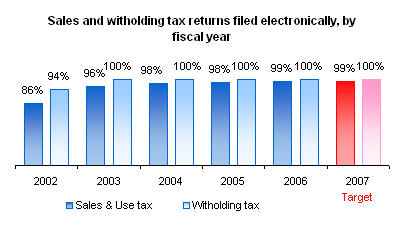

In FY 2006, the department exceeded its electronic return goals for business taxes-98

percent for sales and use tax returns and 99 percent

for withholding returns.

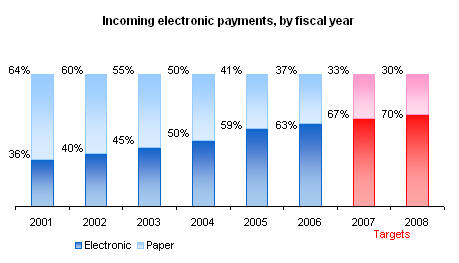

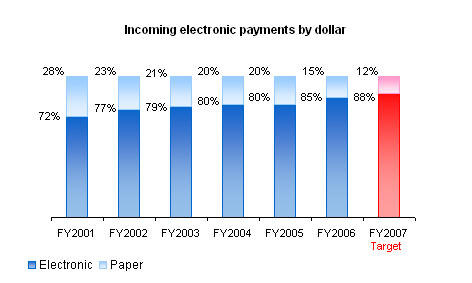

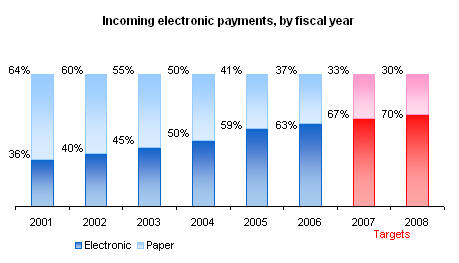

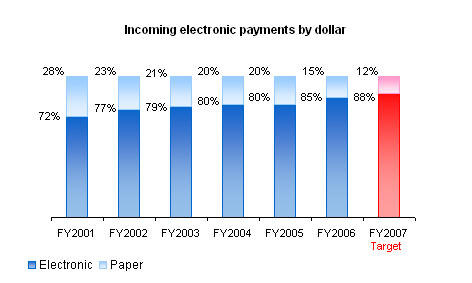

● The number of payments made electronically is an indicator of improved

efficiency of tax payment processing. Electronic payments are less costly to

process. In 2006, 63 percent of payments for all tax types were made

electronically. In terms of revenue, those payments accounted for 85 percent

of dollars received.

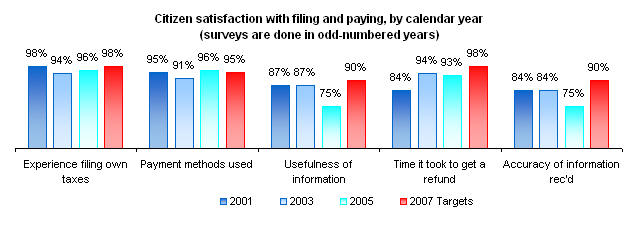

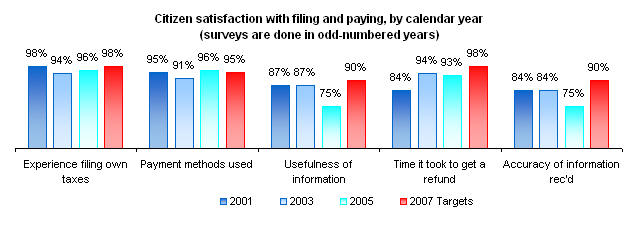

● The department surveys citizens every two years to determine their

satisfaction with the filing process. Their responses tell us whether we are

achieving our goal of making it easy and convenient for taxpayers to fulfill

their filing and paying obligations. According to the 2005 survey results,

93 percent of

respondents said they were satisfied with the time it took to get a refund. Our goal is to increase that

number to 98 percent by the time of the 2007 survey. Usefulness of the

information received from the department was given a satisfaction rating of 75 percent in 2005. Strategies to improve these

survey results and ultimately customer satisfaction with filing and paying,

are being developed.  |

|

Learn more at:

http://www.taxes.state.mn.us/taxes/legal_policy/other_supporting_content/

http://www.taxes.state.mn.us/taxes/legal_policy/other_supporting_content/

leg_pol_other_publications.shtml |

|

|

|

Goal:

Increase e-services for citizens |

|

Why

is this goal important?

In the last decade, the Internet has become a major channel for information

and commerce. Meeting the needs of citizens and businesses for electronic services is

essential to achieving voluntary compliance with the tax system.

How will this goal be accomplished?

We have created web and phone self-service systems to enable

people to get the information they need to file and pay their taxes, check

on their refunds, make payments, update their information, and set up

payment plans for delinquent taxes.

|

|

|

|

|

|

What is

Revenue's progress to date?

●

Use of the department’s web services has

grown dramatically. For example, in 2006, there were over 375,000 visits to

the “Where’s My Refund” web application- 23 percent increase from 2005. This

increase reflects taxpayer acceptance of and appreciation for the

convenience of online services. With the growing reliance on our web

s ervices, fewer calls are coming in to the department's refund information phone line. In 2006, this service received 312,000 calls-a 15 percent

decrease from 2005. ervices, fewer calls are coming in to the department's refund information phone line. In 2006, this service received 312,000 calls-a 15 percent

decrease from 2005.

●

In May 2003, we launched a new online service to make it easier for

people with delinquencies to pay their tax debts. Today, 27 percent of the

pay plans created were made on the web; our goal for 2007 is to increase

this percentage to 30 percent.

●

The department also offers e-services for

businesses. In FY2007, 64 percent of new business registrations were created

on the web. In 2007, the department launched a new service for employers

that enables them to submit employee W-2 forms electronically.

|

|

Goal:

Ensure that the tax system keeps pace with changes in the economy,

demographics and technology |

|

Why is this goal

important?

Minnesota

is home to a growing number of limited English speakers;

between 2000 and 2025, Minnesota’s Asian-Pacific population is

expected to double, and its Hispanic

population will be two and a half times what it is today. Keeping pace with

demographic changes is essential in order to ensure that all citizens have

access to the services and information they need to meet their tax obligations.

The economy continues to shift from

industrial production to services; and traditional bricks-and-mortar

businesses face increasing competition from the electronic marketplace. To

ensure fairness, stability, and adequate revenues, the tax system must accommodate these

changes.

Further, we must keep pace with changes

in technology, both to protect our information and processes, and to improve

the delivery of our services. We are moving our critical database and

network components to newer technologies that will give us the flexibility

to meet demands for services and will ensure the integrity of our

information and processes.

|

|

How will this goal be accomplished?

To reduce the language barriers that keep new citizens from complying with

the tax system, we have hired bilingual employees to provide income tax

education services to the Hispanic, Asian-Pacific, and East African communities.

We provide

tax help and work to establish self-sustaining volunteer groups to provide

consistent, year-to-year help in filing returns. We also provide key tax

information in languages other than English on our website. We provide

tax help and work to establish self-sustaining volunteer groups to provide

consistent, year-to-year help in filing returns. We also provide key tax

information in languages other than English on our website.

Our strategies call for greater

integration of information, improved citizen access to services, and

self-service capabilities for all users. We are working to reduce the

department’s reliance on obsolete technology and to diminish the risk of

system failures by replacing aged computer systems. Besides ensuring the

stability of our applications and the integrity of our information, improved

tools will enable us to provide better information to citizens and policy

makers.

|

|

What is

Revenue's progress to date?

● Progress toward

helping limited-English-speaking Minnesotans meet their tax obligations can

be measured by the number of people served at volunteer tax preparation

sites and the number of state tax returns completed. These

department-sponsored sites serve non-English-speaking, low income, and

elderly Minnesotans. By the end of 2006, the number of state tax returns

completed for the 2005 tax year was 73,705, which represents a 2.6 percent

increase over the number of returns completed for the previous tax year

(71,856).

● Since 2004,

we have offered a bilingual English-Spanish version of the

individual income tax and property tax refund instructions on our website.

Other Spanish-language website offerings include income tax, sales tax, and property

tax fact sheets. Our website also provides information on the Working Family

Credit and the Taxpayer Rights program in eight languages other than

English. In 2006, the department expanded its outreach by offering a

Spanish-language sales tax workshop for new businesses.

●

Increased reliance on new technology and the increase in the number of

electronic and self-service transactions have helped reduce the overall

administrative cost per transaction. As an example, in FY 2006, it cost

$1.15 to process each transaction, which is 2 cents less per transaction

than in FY 2005. ●

In the last two years, we have advanced our modernization goals by replacing

our aging network infrastructure, including updating our desktop and network

operating systems; expanding the IP telephone system to regional offices;

and installing a storage area network ●

We also began the process of modernizing our

property tax system and implemented a new system to accommodate the sales

tax returns and payments that flow from the national Streamline Sales Tax

Project system. ●

Finally, we have converted paper partnership income tax returns to images,

thereby reducing storage space needed for forms and giving employees

immediate access to information, and scanned all correspondence from

delinquent taxpayers, which has created a virtually paperless work

environment in the agency's Collection Division.

|

|

Goal: Improve compliance

with the tax system |

|

Why

is this goal important?

If

Minnesota’s revenue system is to work well, fairness is essential; a fair

system means that everyone pays the right amount of tax, no more, no less.

However, a significant number of individuals and businesses with Minnesota

tax liabilities do not pay all they owe, or do not file or pay at all.

Noncompliance carries a substantial price tag: the Minnesota tax gap—the

estimated difference between what is owed the state and what is actually paid—is

$1.3 billion. To create a fairer tax system for all, these

under-reporters and nonfilers must be brought into compliance.

|

|

|

How will this goal be accomplished?

We

are focusing audit and enforcement activities on those who are furthest from

compliance. Besides the revenues they produce, these activities carry an

additional benefit, in that the visibility they generate also improves

voluntary compliance.

In addition to audit and enforcement, we

have formed partnerships with other states to simplify sales tax collection

on out-of-state purchases, are working to identify ways to reduce the

complexity of the sales tax laws, and are providing education opportunities

for businesses. These efforts will help ensure that everyone is paying the

right amount. |

|

What is

Revenue's progress to date? What is

Revenue's progress to date?

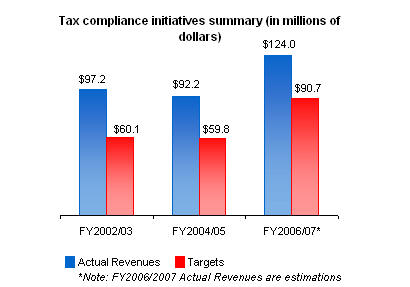

●

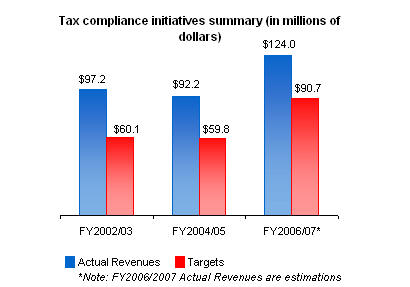

One measure of progress toward improving compliance is to track how much in

increased revenues we are able to collect through stepped-up auditing and

enforcement. In the 2004-2005 biennium, we collected approximately $92.2

million through these compliance initiatives—$30 million more than had been

projected. The department received additional funds for FY 2006-2007; based

on current collections, these initiatives are projected to bring in $124

million by the end of the biennium. This amount would be $33 million more

than had been projected.

|

| |

|

Learn more at:

http://www.taxes.state.mn.us/taxes/legal_policy/other_supporting_content/tax_gap_study.pdf

http://www.taxes.state.mn.us/taxes/legal_policy/other_supporting_content/tax_gap_study.pdf

http://www.taxes.state.mn.us/taxes/legal_policy/research_reports/content/

tax_gap_study.shtml

http://www.taxes.state.mn.us/taxes/legal_policy/research_reports/content/

tax_gap_study.shtml |

|

Last update on

08/08/2007

|

|

ervices, fewer calls are coming in to the department's refund information phone line. In 2006, this service received 312,000 calls-a 15 percent

decrease from 2005.

ervices, fewer calls are coming in to the department's refund information phone line. In 2006, this service received 312,000 calls-a 15 percent

decrease from 2005.