|

DEPARTMENT

RESULTS |

|

|

|

| |

|

Goal: End long-term

homelessness |

|

Why is this goal important?

Long-term homelessness is a breakdown in Minnesota’s social compact –

our vulnerable should not be left to the streets. Long-term homelessness, defined

as lacking a permanent place to live continuously for a year or more or at

least four times in the last three years, is associated with extreme

poverty, poor job skills, lack of education, and serious health conditions.

Beyond their individual issues, people experiencing long-term homelessness

also consume a disproportionate share of emergency room, shelter services,

crisis services and other social services. continuously for a year or more or at

least four times in the last three years, is associated with extreme

poverty, poor job skills, lack of education, and serious health conditions.

Beyond their individual issues, people experiencing long-term homelessness

also consume a disproportionate share of emergency room, shelter services,

crisis services and other social services.

People who have stable housing tend to use fewer crisis

health care services or the services they use are less expensive than when

they were homeless. Successfully housing people reduces social service costs

and provides opportunities for them to become economically self-sufficient,

fully participating members of the community.

|

|

How

will this goal be accomplished? How

will this goal be accomplished?

Minnesota Housing, along with the Departments of Human Services and

Corrections, is a key partner in implementing the Business Plan on Ending

Long-Term Homelessness in Minnesota. Developed by a working group of public

and private stakeholders, the Business Plan aims to provide permanent

supportive housing to an additional 4,000 long-term homeless households by

2010. While the Business Plan originally estimated the cost of creating

these supportive housing opportunities at approximately $540 million over

seven years, funded through federal, state, and local government resources

as well as private contributions, a 2007 recalibration now estimates the

total costs over the lifetime of the plan to be $483 million.

Minnesota Housing funds the development, rehabilitation,

acquisition, or preservation of supportive housing through programs such as

the Housing Trust Fund, the Family Homeless Prevention and Assistance

Program, and the Ending Long-Term Homelessness Initiative Fund. The agency

also provides operating subsidies and rental assistance for permanent

supportive housing for people experiencing long-term homelessness.

|

|

What is Minnesota Housing's progress to date?

As of December 2006, Minnesota Housing has funded 1,091 units of

supportive housing opportunities for people experiencing long-term

homelessness. Compared to the Business Plan’s goal of 1,000, Minnesota

Housing is 9 percent ahead of the target and 27 percent of the way toward

the 2010 goal of 4,000 housing units.

Learn more at:

http://www.mhfa.state.mn.us/multifamily/LTH.htm

Learn more at:

http://www.mhfa.state.mn.us/multifamily/LTH.htm |

|

|

|

Goal: Increase minority homeownership |

|

Why is this goal important?

Homeownership is a principal element of the

American dream. For most Americans, homeownership is the most primary means

of wealth accumulation, and national and state policies have long encouraged

homeownership because of its impact on strengthening families and building

communities. Homeowners demonstrate higher levels of academic achievement,

and greater civic and voluntary involvement.

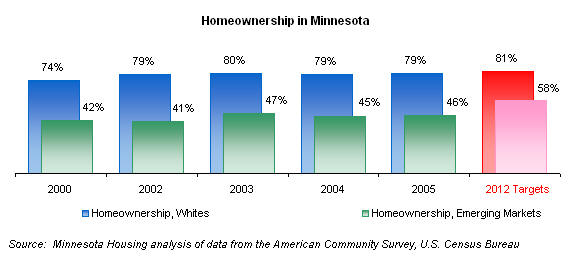

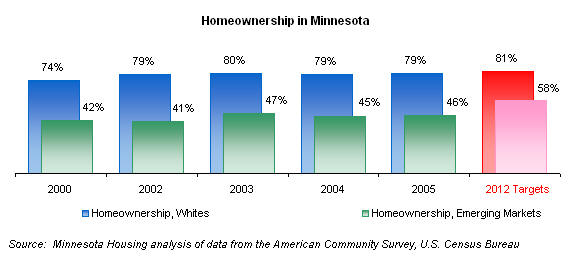

Minnesota’s overall homeownership rate is the highest in the nation at 75.8

percent. However, the overall rate for communities of color and/or Hispanic

ethnicity in Minnesota is significantly lower than the rate for white

Minnesotans. This homeownership gap stymies the American dream and prevents

wealth creation for households of color and/or Hispanic ethnicity.

Minnesota Housing estimates that the

homeownership gap between white-headed households and households of color

and/or Hispanic ethnicity in 2005 was 33 percentage points, placing

Minnesota in the top ten states for the largest homeownership gap. |

| |

|

How will this goal be accomplished?

Minnesota Housing, along with the Federal Reserve Bank of Minneapolis and

the Fannie Mae Minnesota Community Business Office, convened the Emerging

Markets Homeownership Initiative (EMHI). In 2005, EMHI worked with the

homeownership industry to develop a detailed business plan to increase

homeownership in Minnesota’s emerging markets. Representing the input of

over 50 stakeholders, the business plan identifies twelve strategies

targeted to emerging markets that will:

enhance trust in the home buying

process (e.g., recruit diverse homeownership

enhance trust in the home buying

process (e.g., recruit diverse homeownership

in dustry

professionals); dustry

professionals);

expand outreach (e.g., develop

culturally-

expand outreach (e.g., develop

culturally-

sensitive homebuyer training); and

grow product innovations (e.g.,

expand

grow product innovations (e.g.,

expand

culturally-sensitive mortgage products and

underwriting processes)

The EMHI Initiative has been incorporated

as an independent 501(c)3 nonprofit organization. Work continues to convene

representatives from leading financial institutions, real estate

organizations, trade associations, and diverse community organizations to

develop pilot implementation of the EMHI business plan strategies.

In early 2006, Minnesota Housing implemented significant changes to some

first-time homebuyer programs to better target the emerging markets

population.

|

|

What

is Minnesota Housing's progress to date?

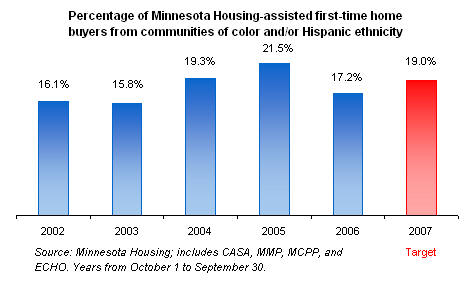

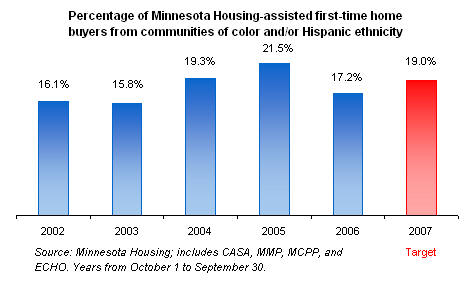

Minnesota Housing has increased its percentage of first-time home buyers

from communities of co lor and/or Hispanic ethnicity from less than 16

percent in FY 2003 to nearly 22 percent in FY 2005. Actual performance in FY

2006 slipped to 17 percent as a result of organizational issues with one key

lending partner. The agency estimates that 17 percent of households

estimated to be eligible for Minnesota Housing assistance are from

communities of color and/or Hispanic ethnicity. lor and/or Hispanic ethnicity from less than 16

percent in FY 2003 to nearly 22 percent in FY 2005. Actual performance in FY

2006 slipped to 17 percent as a result of organizational issues with one key

lending partner. The agency estimates that 17 percent of households

estimated to be eligible for Minnesota Housing assistance are from

communities of color and/or Hispanic ethnicity.

Learn more at:

http://www.mhfa.state.mn.us/homes/EMHI.htm

Learn more at:

http://www.mhfa.state.mn.us/homes/EMHI.htm |

| |

|

Goal:

Preserve strategically the existing affordable housing stock |

|

Why is this goal

important?

Much of our state’s existing single-family and multifamily affordable

housing stock is at risk of deteriorating, and replacement is

cost-prohibitive. No affordable housing development can produce housing that

is as affordable to residents as maintaining the existing stock of federally

assisted rental housing or bringing substandard single-family housing into

service. Preserving this housing costs substantially less per unit than new

construction and leverages federal rent or mortgage subsidies well into the

future.

Currently, there are approximately

100,000 units of multifamily rental housing that have received or currently

receive federal or state assistance to keep them affordable. Approximately

170,000 additional units provide affordable rental housing opportunities

without direct assistance. As these rental properties age or as subsidy

contracts and regulatory agreements expire, these units may convert to

unaffordable market rate housing or simply be lost due to deterioration.

Preservation helps eliminate the danger of housing becoming unaffordable for

low- and moderate- income households.

|

|

|

|

How will this goal be accomplished?

Minnesota Housing strategies focus on preserving the affordability of

multifamily housing and on rehabilitating and improving aging single-family

homes. The agency emphasizes opportunities for community partnerships and

leveraging activities to maximize the continual use of Minnesota’s existing

housing inventory.

To preserve affordable rental housing, Minnesota Housing strategies include

changes to underlying financing, operating subsidies to owners, direct

subsidies to tenants, or simply through the existing rent structure. The

agency also monitors situations where federal assistance for existing rental

housing is in jeopardy and examines whether using state funds to preserve

this housing is appropriate, necessary and cost-effective. Minnesota Housing

coordinates its preservation efforts with its funding partners – the Family

Housing Fund, the Greater Minnesota Housing Fund, the U.S. Department of

Housing and Urban Development, Rural Development (U.S. Department of

Agriculture), and the cities of Minneapolis and St. Paul.

Home improvement programs preserve Minnesota's existing single-family

housing stock with property rehabilitation, weatherization, remodeling and

housing recycling activities. Delivered through an extensive network of

partners and lenders, these programs reach a broad range of household

incomes and properties.

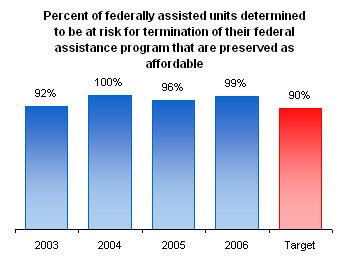

What

is Minnesota Housing's progress to date?

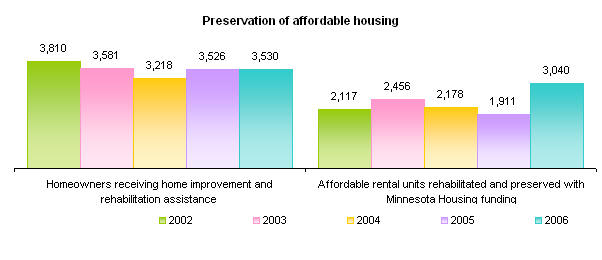

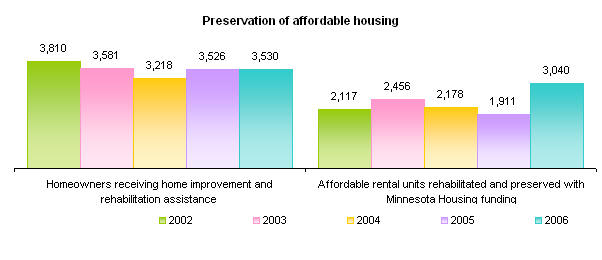

In FY 2006, Minnesota Housing disbursed funds to rehabilitate, improve,

or preserve the affordability of over 6,500 units of existing single and

multifamily housing. This activity includes $15.7 million to preserve more

than 800 units of existing subsidized rental housing through Affordable

Rental Investment Fund-Preservation (PARIF) and $4.1 million to rehabilitate

nearly 400 units of housing occupied by low-income homeowners through the

Rehabilitation Loan Program. Loans on a few large housing developments

closed in 2006, leading to the 50 percent increase in affordable rental

units rehabilitated and preserved.

Preservation of existing housing remains the most

cost-effective means of providing affordable housing. Each dollar of state

spending under various Agency programs, since 1998, has leveraged $5.30 of

federal investment in affordable rental housing.

Learn more at:

Learn more at:

http://www.mhfa.state.mn.us/homes/homes_improvement.htm

http://www.mhfa.state.mn.us/multifamily/multifamily_preserving.htm

|

| |

|

Goal: Low-and-moderate income workers have affordable housing |

|

Why is this goal

important?

Families who pay more than 30 percent of their income for housing are

considered cost-burdened and may have difficulty affording necessities such

as food, clothing, transportation and medical care. The lack of affordable

housing is a significant hardship for low-income households preventing them

from meeting their other basic needs or saving for their household’s future.

By providing affordable housing to low- and moderate-income workers,

Minnesota Housing allows Minnesota’s workforce, the backbone of the state’s

economic growth and vitality, to focus their energies on their jobs, their

communities and their families.

By developing affordable housing in areas of the greatest employment growth,

Minnesota Housing supports efforts to decrease commuter times and reduce

traffic congestion in inter-regional corridors. Housing close to jobs also

minimizes household transportation costs, allowing households to spend more

on housing and other needs. |

| |

|

How will this goal be accomplished?

Minnesota Housing provides construction and permanent mortgage financing to

sponsors and developers of affordable rental housing, monthly rent

assistance vouchers to qualifying low-income households, and entry cost

assistance and permanent mortgage financing to qualifying first-time

homebuyers.

Minnesota Housing works to increase housing choices

for low- and moderate-income workers by collaborating

with employers, philanthropic organizations, local governments, nonprofits,

and other partners – including the Family Housing Fund, the Greater

Minnesota Housing Fund, and the Metropolitan Council – to provide greater

affordable housing opportunities. Selection guidelines for the Minnesota’s

Housing’s Economic Development and Housing Challenge Fund prioritize funding

proposals that locate housing close to areas of job growth, transit ways,

and transportation corridors or that include employer or local contributions

to increase the affordability of housing.

|

|

What is

Minnesota Housing's progress to date?

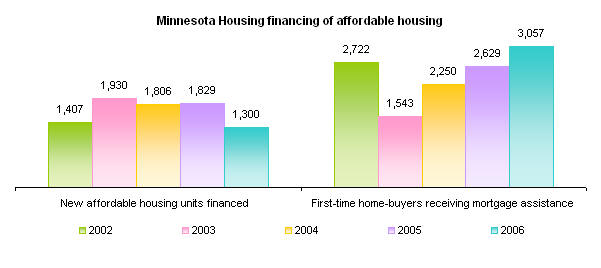

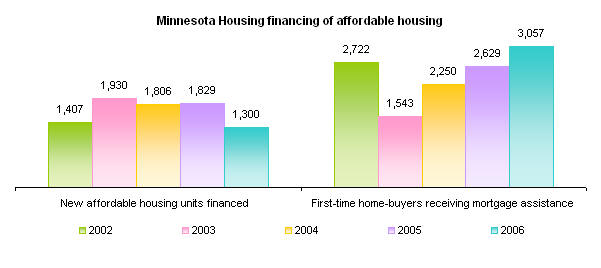

The changing climate of the private mortgage market has made

Minnesota Housing products once again more appealing to low- and

moderate-income borrowers. First-time mortgages have jumped to over 3,000 in

FY 2006 for the first time since 1997.

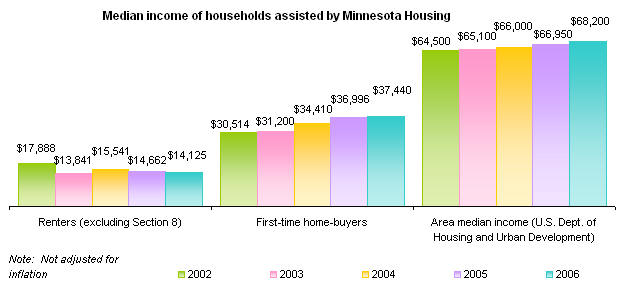

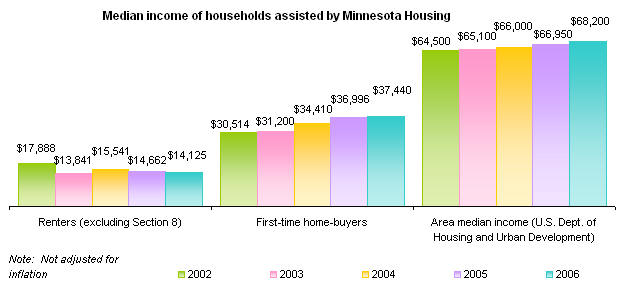

The median household income of first-time home-buyers assisted by the agency

has inched up to $37,440 or 55 percent of the area median family income

defined by the U.S. Department of Housing and Urban Development (HUD).

Stable from 2005, this compares to 47 percent in 2002. The median household

income of renters Minnesota Housing assists (excluding Section 8 rental

assistance) is $14,125 or 21 percent of the HUD area median income. This

compares to 28 percent in 2002 and 21 percent in 2003.

Learn more at:

http://www.mhfa.state.mn.us/

Learn more at:

http://www.mhfa.state.mn.us/ |

| |

|

Goal: Establish Minnesota Housing as a housing partner of choice |

|

Why is this goal

important?

Minnesota Housing cannot achieve its goals independent of the

developers, local units of government, financial institutions, and community

organizations who partner with the agency and are often the face of agency

products to end consumers. Limited resources require redoubled efforts at

customer service, collaboration, and creativity.

|

|

How will this goal be accomplished?

Externally, Minnesota Housing has established the

Housing Resource Advisory Council as a forum for discussing how the agency’s

resources can complement our partners’ efforts to promote affordable

housing. The Council includes representatives from local government, housing

and redevelopment and community development authorities, philanthropic

organizations, local financial and technical assistance organizations, and

financial advisors. The exchange of information and ideas around economic

development, affordable housing and homelessness helps inform Minnesota

Housing’s funding decisions and facilitate coordination of activities and

funding requests at the local level.

Internally, the agency has implemented a Customer Service Initiative focused

on transforming internal business processes to improve the agency’s service

to customers. Key strategies of the Customer Service Initiative have

included enhancing the use of technology, reviewing the agency’s

regulatory/underwriting standards, seeking program consolidation and

simplification opportunities, and learning from other organizations through

“best practice” reviews. |

| |

|

What is Minnesota

Housing's progress to date?

For the last year, Minnesota Housing has focused on enhancing the use of

technology. The Single Family Mortgages Online System (SFMOS) is a web-based

business-to-business system implemented in April 2007. Lending partners can

access to the system through a web interface to qualify for affordable

housing loans for purchase by Minnesota Housing. SFMOS will result in

improved service and on-line access for lending partners to do business with

Minnesota Housing. The agency is also implementing a new underwriting system

for multifamily rental developments that will improve Minnesota Housing’s

capacity to maintain accurate data for reporting and program analysis.

Eventually this system will be integrated with a new web-based application

and web-based underwriting that will be made available to our business

partners.

Learn more at:

Learn more at:

http://www.mhfa.state.mn.us/homes/SFMOS.htm

http://www.mhfa.state.mn.us/about/MF_CSinitiative.pdf

|

|

Some images © 2003 www.clipart.com |

|

Last update on

07/27/2007 |

continuously for a year or more or at

least four times in the last three years, is associated with extreme

poverty, poor job skills, lack of education, and serious health conditions.

Beyond their individual issues, people experiencing long-term homelessness

also consume a disproportionate share of emergency room, shelter services,

crisis services and other social services.

continuously for a year or more or at

least four times in the last three years, is associated with extreme

poverty, poor job skills, lack of education, and serious health conditions.

Beyond their individual issues, people experiencing long-term homelessness

also consume a disproportionate share of emergency room, shelter services,

crisis services and other social services.

dustry

professionals);

dustry

professionals); lor and/or Hispanic ethnicity from less than 16

percent in FY 2003 to nearly 22 percent in FY 2005. Actual performance in FY

2006 slipped to 17 percent as a result of organizational issues with one key

lending partner. The agency estimates that 17 percent of households

estimated to be eligible for Minnesota Housing assistance are from

communities of color and/or Hispanic ethnicity.

lor and/or Hispanic ethnicity from less than 16

percent in FY 2003 to nearly 22 percent in FY 2005. Actual performance in FY

2006 slipped to 17 percent as a result of organizational issues with one key

lending partner. The agency estimates that 17 percent of households

estimated to be eligible for Minnesota Housing assistance are from

communities of color and/or Hispanic ethnicity.