|

||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||

|

Goal: Ensure the integrity of the state's financial resources |

||||||||||||||||||||||||||||||||||

|

Why is this goal important? |

||||||||||||||||||||||||||||||||||

|

Through these channels the Department of Finance is working to ensure the integrity of the state's financial resources. |

||||||||||||||||||||||||||||||||||

|

How will this goal be accomplished? |

||||||||||||||||||||||||||||||||||

|

The Finance

Department seeks to reduce the number of repeat audit findings by assuring

that agencies make the necessary corrections, and assists them in

implementing audit Additionally, by maintaining one of the highest bond ratings, Minnesota is able to command the lowest price for borrowing money to build roads, buildings, and other important infrastructure. The Department of Finance is a strong advocate for maintaining Minnesota’s high bond rating. Finance advises the Governor and legislative leadership on budget options that maintain a high bond rating.

|

||||||||||||||||||||||||||||||||||

|

What is the Department's progress to date? |

||||||||||||||||||||||||||||||||||

|

Audits |

||||||||||||||||||||||||||||||||||

| Goal: Respected organizations say that the state is fiscally well-managed | ||||||||||||||||||||||||||||||||||

|

Why is this goal important? |

||||||||||||||||||||||||||||||||||

|

Outside sources, including three credit rating agencies and Governing Magazine, rate the state's financial performance. Governing Magazine analyzes states' overall management through the Government Performance Project (GPP), a program sponsored by grants from the PEW Charitable trust, and provides a source of comprehensive and independent information about state management performance. Grades by management area provide states comparative information that can be used to improve management. Results and comparative information can be accessed at http://results.gpponline.org. Rating agencies also provide the state with financial guidance and critical assessments that aid in determining Minnesota's creditworthiness. Finance officials discuss the state's financial status with these agencies around the time of each major economic forecast, bond sale, and start/end of legislative sessions. The agencies are Moody's Investor Service, Standard & Poor's Corporation, and Fitch Ratings. |

||||||||||||||||||||||||||||||||||

|

How will this goal be accomplished? |

||||||||||||||||||||||||||||||||||

|

Minnesota's financial management practices are rated A-, placing Minnesota among the best nationally. Only three states rank higher. The department uses survey criteria and comparisons to best practices nationally to identify areas for potential improvement. |

||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||

|

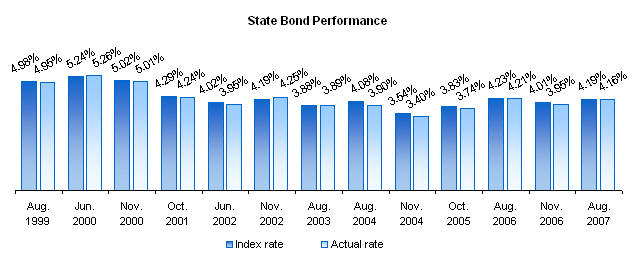

The State’s AAA/Aaa bond rating is a key measure of the State’s creditworthiness. Currently, Minnesota has the highest rating from Fitch and Standard & Poor's, but Moody's rates the state second highest at Aa1. Maintaining the AAA bond rating from Fitch and Standard & Poor's and regaining the Aaa bond rating from Moody's is one of the Department's key priorities. Although the Department of Finance champions this goal, the state’s bond rating is determined by a myriad of factors, many of which are outside of the Department’s direct control.

Rating agencies track trends and compare Minnesota’s credit worthiness to those of other states. Thus, regaining the Aaa Moody’s rating is a long-term challenge and we can expect to regain that status if responsible financial management and leadership is prominent in the legislative process. |

||||||||||||||||||||||||||||||||||

| Goal: Improve accountability and the prudent use of state resources | ||||||||||||||||||||||||||||||||||

|

Why is this goal important? |

||||||||||||||||||||||||||||||||||

|

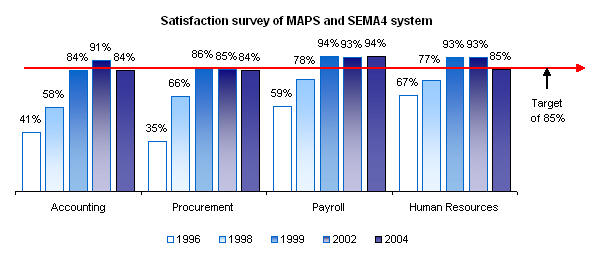

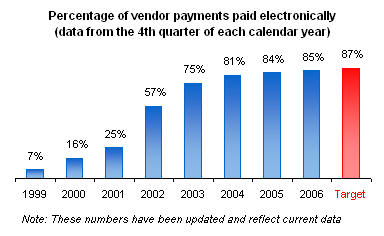

Improving the accountability and prudent use of the state’s resources is an important goal that is attained through these strategies: paying vendors within 30 days, increasing the percentage of vendor payments made electronically, and improving the satisfaction with the Statewide Administrative Systems.

Percentage of vendor payments made within 30 days.

This measures how often

vendors providing goods and services to the state of Minnesota are paid

within 30 days. Prompt payment to vendors is good business p Percentage of vendor payments paid electronically. Payments by electronic fund transfer (EFT) are faster, safer, and save state resources.

Satisfaction with Statewide Administrative Systems (MAPS & SEMA4).

|

||||||||||||||||||||||||||||||||||

|

How will this goal be accomplished? |

||||||||||||||||||||||||||||||||||

|

Percentage of vendor payments paid

electronically. Finance

has upgraded its systems to allow for more payments to be made via EFT. A

website provides vendors with free 24 hour access to EFT payment

information. The 2003 legislative session passed a Department of Finance

proposal to require vendors that receive more than $10,000 or ten payments

from the state to do so via EFT payments. |

||||||||||||||||||||||||||||||||||

|

What is the Department's progress to date? |

||||||||||||||||||||||||||||||||||

|

Percentage

of vendor payments made within 30 days. Since

1997, the state target has had a target of paying 98 percent of vendors within 30 days. Finance has exceeded its 98 percent target of paying

vendors within 30 days since 2003.

|

||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||

|

The 2004 Statewide Administrative Systems Survey results have been posted on the Department of Finance’s web site at: http://www.finance.state.mn.us/agencyapps/survey/results/index.html |

||||||||||||||||||||||||||||||||||

|

Some images © 2003 www.clipart.com |

||||||||||||||||||||||||||||||||||

|

The

Department of Finance is able to carry out this goal through two primary

means--

The

Department of Finance is able to carry out this goal through two primary

means--

ractice and

state law. Vendors not paid promptly are eligible for interest payments.

ractice and

state law. Vendors not paid promptly are eligible for interest payments.

Percentage

of vendor payments made within 30 days.

Percentage

of vendor payments made within 30 days.